Tariff Codes

NOTE: The screens depicted in these Help files reflect Quick Ship Version 5.4.0.XXXX and E10 Version 10.2.700.5. Earlier Versions may not have the same screens.

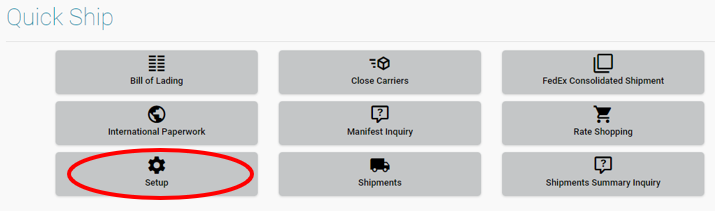

From the initial entry screen, select 'Setup'.

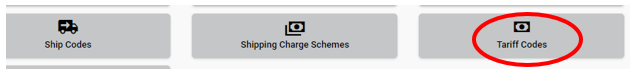

Select 'Tariff Codes' icon.

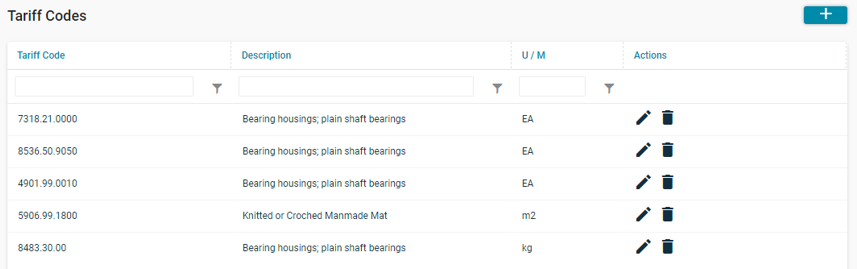

The Tariff Codes file records the Schedule B code classifications which encompass all the products to be exported by the shipper. These records are used for creating export documentation and for electronic filing of the shipper's export declaration. Each Product record should be assigned to a Schedule B Code classification to ensure that export documentation is completed accurately in order for duties and taxes to be calculated correctly based on the origin/destination countries of the shipment.

Select Edit pencil to View/Edit Tariff Codes.

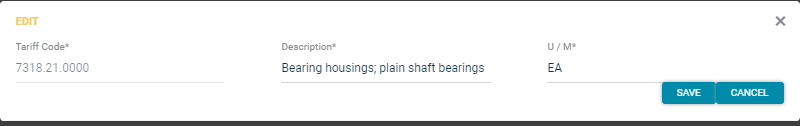

General Tab

Tariff Code:

This required field is used to enter the standardized tariff code.

Note: Tariff codes must be in 9999-99, 9999-99-9999 format.

URL for Tariff Codes:

https://www.census.gov/foreign-trade/schedules/b/index.html?utm_campaign=&utm_medium=email&utm_source=govdelivery

Description:

This required field is used to enter the standardized commodity description for the selected tariff code. This description will be used when creating export documentation and electronic filings.

U/M:

This required field is used to enter the accepted unit of measure when reporting products that are associated with the selected tariff code classification.

NOTE:

This UOM MAY or MAY NOT be the same as the E10 Stock UOM.

It is important that the shipper ship quantities in the unit of measure that is defined for the specific Schedule B Class that the commodity falls in to, and that the item’s unit weight is entered in pounds. For example, any commodity that falls under Schedule B Class 7318.21.0000 (Spring washers and other lock washers) must be reported in kilograms. Failure to ship in quantities of kilograms could cause a filing to be incorrect because ISS will upload the packed quantity and AES will assume this to be in kilograms. This could create a filing to be incorrect if the shipper packed using number of units vs. total kilograms.