NOTE: The screens depicted in these Help files reflect Quick Ship Version 5.4.0.XXXX and E10 Version 10.2.700.5. Earlier Versions may not have the same screens.

E10 International fields that will automatically pull into Quick Ship.

You will NOT be able to Freight an International shipment in E10 without the required fields populated.

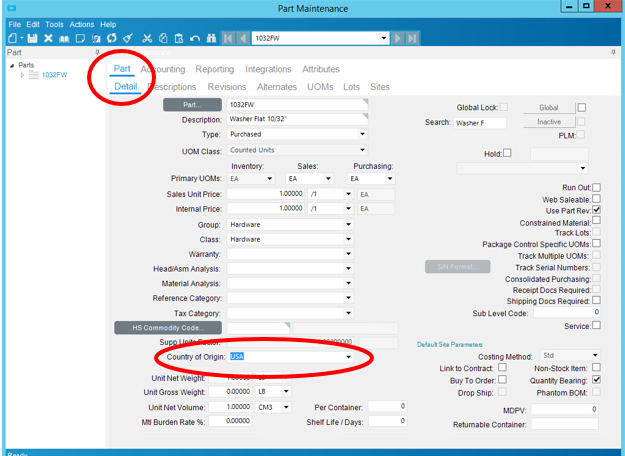

Material Management | Inventory Management | Set Up | Part:

Detail Tab:

REQUIRED:

Country Of Origin:

Select appropriate Country of Origin from the pull down list.

If specific Country is NOT in list, right click on the Part Country of Origin field (Not the Label).

Select Open With…..Country Entry

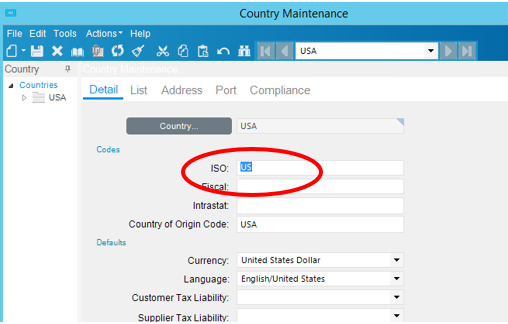

Create new country code OR enter the correct ISO Country code. (See Country Listing in Manifest.)

NOTE: The E10 Country File MUST have the appropriate ISO Code entered.

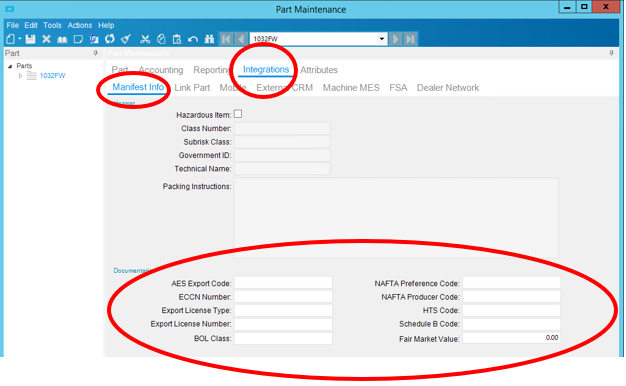

Integrations | Manifest Info Tab:

REQUIRED:

Schedule B Code:

Enter the 10 digit code with dashes for the part.

OPTIONAL:

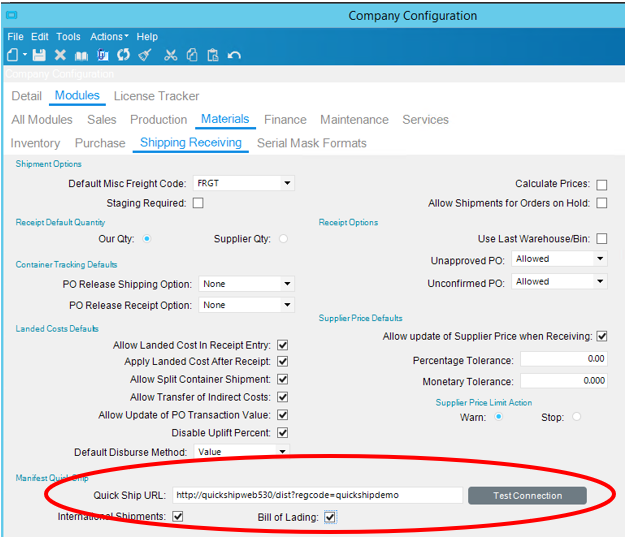

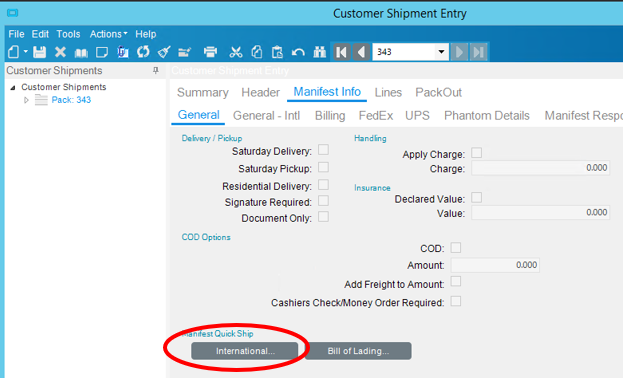

Automatic access to Quick Ship for International screens.

By using this function, you will be able to logon to Quick Ship directly from E10 without leaving the E10 application.

If the information for your International shipment needs adjusting each time. i.e. Defaults for International shipments, Shipment Values etc. You can make the changes in this Quick Ship window, save it, print the form and/or return to E10 and Freight the shipment.

NOTE: this option can be accessed before or after Freighting the shipment.

NOTE: If using this option, you may want to verify the E10 Customer Shipment | Manifest Info | General-Intl tab does not have Form/Forms Checked to automatically print when freighted.

Quick Ship URL:

http://Server Name/dist?regcode=Registration Code

By utilizing these fields, you will be able to access the E10 'International...' button. A new Quick Ship Window will open allowing you to login directly to the International Paperwork Screen.

AES Export Codes:

This code identifies the type of export shipment or conditions of the exported items (i.e. goods donated for relief or charity, impelled shipments, shipments under the Foreign Military Sales program, household goods, all other shipments). The Census Bureau tells us that the overwhelming majority of exports use the code: OS – All Other Exports.

Enter relevant Export Code.

CH-GOODS DONATED FOR RELIEF OR CHARITY

CI-IMPELLED SHIPMENTS OF GOODS DONATED FOR RELIEF OR CHARITY

CR-GOODS MOVING UNDER A CARNET

DD-OTHER EXEMPTIONS

FI-IMPELLED FOREIGN MILITARY SALES

FS-FOREIGN MILITARY SALES

GP-U.S. GOVT. CONTRACT FOR OVERSEAS CONTRUCTION

GS-EXPORTS FOR EXCLUSIVE USE OF U.S. GOVT AGENCIES

HH-PERSONAL AND HOUSEHOLD EFFECTS AND TOOLS OF TRADE

HV-PERSONALLY OWNED VEHICLES

IP-IMPORTED TEMPORARILY FREE UNDER BOND EXPORTED AFTER PROCESSING IN U.S.

IR-IMPORTED TEMPORARILY FREE UNDER BOND EXPORTED AFTER REPAIR OR ALTERATION IN U.S.

IS-IMPORTED TEMPORARILY FREE UNDER BOND EXPORTED IN SAME CONDITION

IW-SHIPMENTS DESTINED TO INTERNATIONAL WATERS

MS-EXPORTS FOR EXCLUSIVE USE OF U.S. ARMED FORCES

OI-OTHER IMPELLED EXPORTS

OS-GENERAL EXPORTS (ALL OTHERS)

TE-TEMPORARY EXPORT OF GOODS FOR RETURN TO U.S. IN SAME COND.

TL-MERCHANDISE EXPORTED ON LESS THAN 1 YEAR LEASE

TP-TEMPORARY EXPORT OF DOMESTIC GOODS FOR PROCESSING AND RETURN

UG-SINGLE GIFT PARCELS

ZD-N A F T A DUTY DEFERRAL SHIPMENTS

ECCN:

ECCN, stands for Export Control Classification Number. An ECCN is an alpha-numeric classification used in the Commerce Control List to identify items for export control purposes. An ECCN is different from a Schedule B number, which is used by the Bureau of Census to collect trade statistics. It is also different from the Harmonized Tariff System Nomenclature, which is used to determine import duties.

All ECCNs will have 5 characters, for example, 1A001, 4B994, or 8D001. There are 10 categories on the Commerce Control List. The first number of the ECCN identifies the category to which it belongs, for example, 1 = Nuclear Materials Facilities and Equipment, 4 = Computers, 9 = Propulsion Systems, Space Vehicles and Related Equipment.

However, EAR99 is a different type of classification. It serves as a "basket" designation for items that are covered by the EAR, but are not specified on the Commerce Control List. EAR99 items can be shipped without a license to most destinations under most circumstances. There are limitations on the use of EAR99. However, the majority of the commercial exports from the United States fall into this category.

A key in determining whether an export license is needed from the Department of Commerce is finding out if the item you intend to export has a specific Export Control Classification Number (ECCN). ECCNs are five character alpha-numeric designations used on the Commerce Control List (CCL) to identify dual-use items for export control purposes. An ECCN categorizes items based on the nature of the product, i.e. type of commodity, software, or technology and its respective technical parameters.

An ECCN is different from a Schedule B number, which is used by the Bureau of Census to collect trade statistics. It is also different from the Harmonized Tariff System Nomenclature, which is used to determine import duties.

All ECCNs are listed in the Commerce Control List (CCL) (Supplement No. 1 to Part 774 of the EAR), which is divided into ten broad categories, and each category is further subdivided into five product groups. The first character of the ECCN identifies the broader category to which it belongs and the second character identifies the product group (see example and boxes below).

If Your Item is Not on the Commerce Control List - EAR99

If your item falls under the jurisdiction of the U.S. Department of Commerce and is not listed on the CCL, it is designated as EAR99. The majority of commercial products are designated EAR99 and generally will not require a license to be exported or reexported. However, if you plan to export an EAR99 item to an embargoed or sanctioned country, to a party of concern, or in support of a prohibited end-use, you may be required to obtain a license.

NAFTA/USMCA Preference Code:

A Preference Criterion is a statement about the origin of a product, which qualifies the product for preferential treatment under USMCA. Select the Preference Criterion that applies to each product.

Six Preference Criteria, labeled A through F.

A:

Products that contain only North American parts of Materials. This category is generally used for basic products, such as those harvested, mined or fished in the USMCA territory. It can also include a manufactured product with USMCA only inputs. (Reference: Articles 401(a) and 415)

B:

Products manufactured in the USMCA region that contain a foreign component but still meet the rule of origin requirements for that product set out in Annex 401. (Reference: Article 401(b))

C:

Goods produced entirely in Canada, Mexico and/or the United States, exclusively from materials that originated in those countries. (Reference: Article 401(c))

D:

Goods that do not meet the rule of origin requirements but that qualify for preferential USMCA treatment because they meet a regional value content requirement. (Reference: Article 401(d))

E:

Certain automatic data processing goods and their parts which, although they do not originate in the territory, are considered as "originating" upon importation. (Reference: Annex 308.1)

F:

Agricultural goods that are categorized under preference criteria A, B, or C and which are not subject to a quantitative restriction (no tariff rate quota) in the importing country. Note that this category does not apply to goods that wholly originate in either Canada or the United States and are exported from one of these countries to the other.

NOTE: the above preference criteria are described in general terms for informational purposes only. Quick Ship/E10 recommends that shippers who are unsure of the legal position of any shipment consult their country's customs agency.

NAFTA/USMCA Producer Code:

Enter one of the following: Yes, NO(1), NO(2), NO(3) based on the following definitions:

YES = you are the producer of the good.

NO(1) = you are not the producer of the good, but are able to fill out the Certificate based upon your knowledge of whether the good qualifies.

NO(2) = you are not the producer but are relying upon written representation from the producer (other than the Certificate of Origin) that the good qualifies.

NO(3) = you are not the producer but have a USMCA Certificate of Origin for the good provided to you voluntarily by the producer.